PIMCO 15+ Year US TIPS Index ETF (LTPZ) - Excellent inflation protected treasuries (TIPS)

Last updated: May 25, 2022

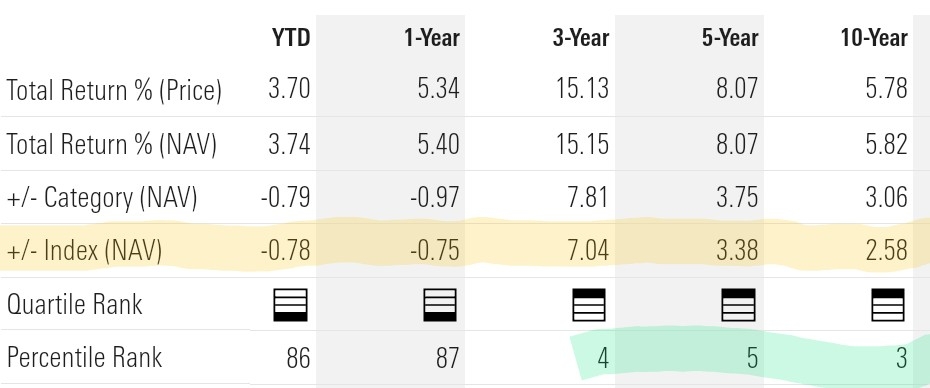

Above inexpensive long duration TIPS ETF has produced top notch long term return. In fact, it's almost two to three times that of Total Bond index.

As an active fund, it has outperformed even standard TIPS index too.

LTPZ outperformance comes at cost of more volatility than it's index. For example, it's standard deviation (measure of volatility) is almost 3 times of it's index:

When risk is taken out of the equation, the strategy's absolute performance looks more positive. On a 10-year basis, it has beaten the category index on an annualized basis by 2.4%.

So my advice for investors would be to ignore volatility in short term and give it two years of time. It's likely to be widely ahead of it's index by then.

Are you frustrated with performance of this ETF after buying it in 2021 following my tip? Are you considering cutting your losses by selling it before it drops further?

Well, this long duration TIPS ETF is known for turning out to be a topper next year after every year of being at bottom. See it's percentile rank below for last 3 such occurrences:

I believe it would be able to repeat it's laggard-to-leader hat trick next year too.

BTW, due to it's beating in 2022, it's current last month's annualized interest yield of 14.6% (as of May, 2022) is close to double of most of Series I Savings Bonds return being offered by treasurydirect currently.

Source: Morningstar Performance Tab

Source: Morningstar Performance Tab

Comments

Post a Comment