GlobalX US Infrastructure Dev ETF (PAVE) - Inexpensive infrastructure ETF with high return potential

GlobalX US Infrastructure Dev ETF (PAVE) seems to be a good choice to capitalize on Biden's infrastructure bill spending for next couple of years. It has performed very well in it's domestic infrastructure category, since it's inception 4 years back.

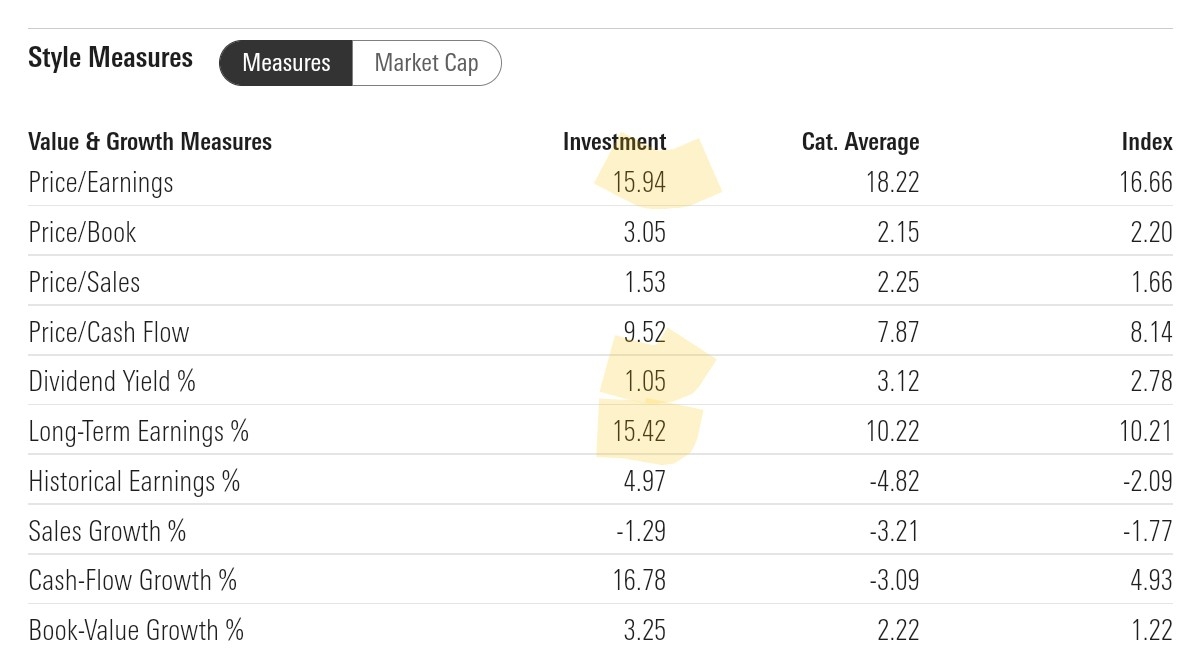

It's PE ratio is 20% lower than that of broad Total Stock index, even though its long term earnings growth projection of 15% is quite similar to that of Total Stock index. It's expense ratio of 0.47% is little bit on higher side though. However, it's comparable to expense ratio of focused asset class such as infrastructure.

Source: Morningstar Portfolio view page

This fund seems to have outperformed Morningstar Gbl Eq Infrastructure index big way by mainly focusing into small/mid size growth-value blend industrial infrastructure companies. Hope it's able to do same in future.

Above outperformance does come with some volatility risk (standard deviation 25% as compared to 16% for index). Key is to have some patience and ride the volatility wave.

Comments

Post a Comment