What gross income qualifies one to be in lower tax bracket

Joint household with 150K (163K for 50+ age group) gross income could be still in lower 12% tax bracket. Wondering as how is this possible?

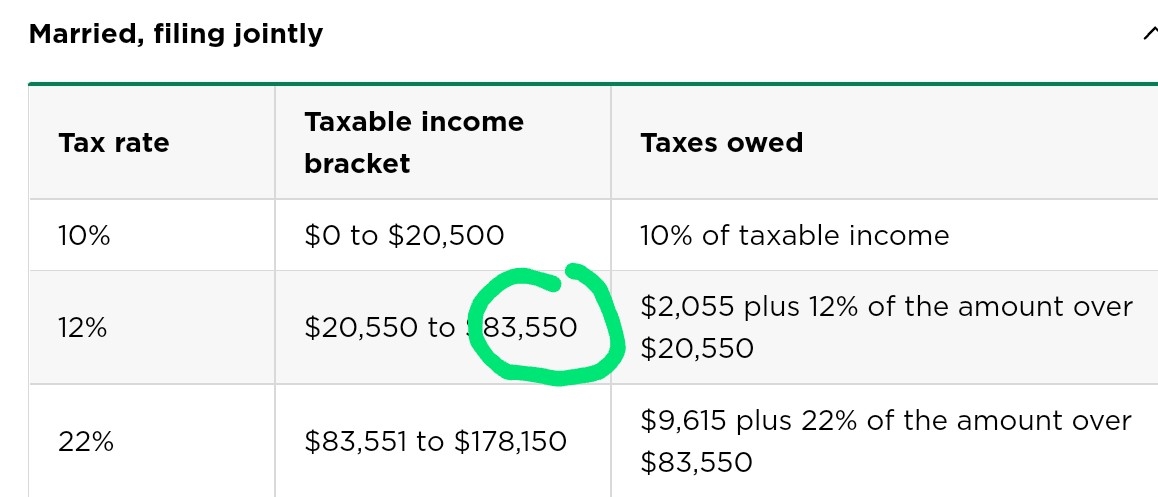

With this deduction, higher tax bracket of 22% kicks in as we cross threshold 83.5K of taxable income:

So in essence, joint household is in lower tax bracket for first 26K+83.5K=109.5K gross income for year 2022.

I found Engaging Data web site to be easy to use resource for one to visually see one's tax bracket with full breakup of above kind of data:

Now, we have tax deferral room of 20.5K (27K if 50+ age) for each 401(K) participant in the household. So, if both members of joint household contributing max 20.5K to 401(k) plan, they could be still in lower 12% tax bracket with household gross income of 109.5K+20.5K+20.5K=150K (163K for 50+ age group).

It's best to act on our tax deferral strategy now, as new year kicks in. Let's set and forget now.

Informative post!

ReplyDelete