Why millennials need to prioritize on starting early in investing as compared to their parents

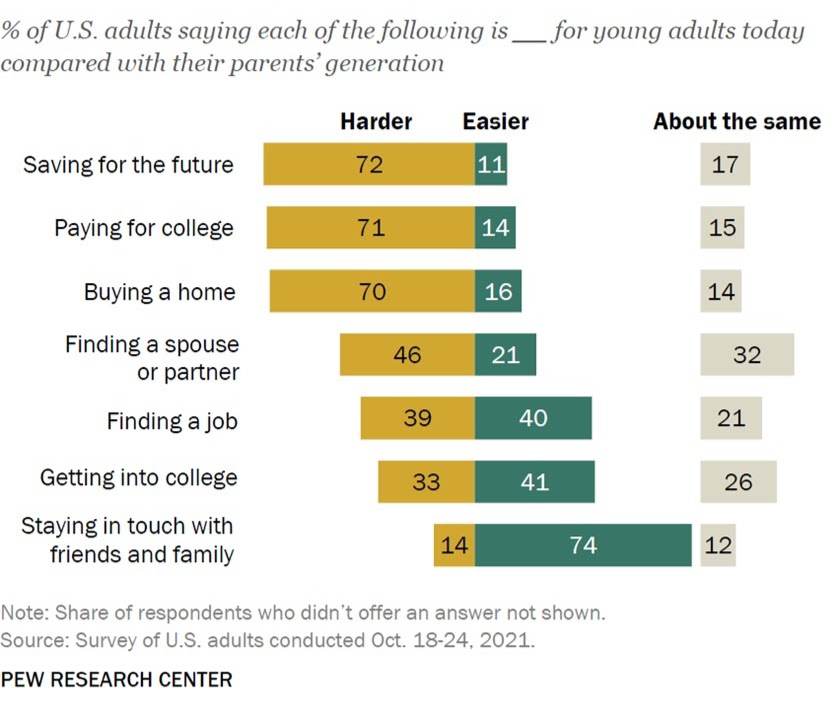

"When it comes to savings, paying for college and home-buying, most say young adults today have it harder than their parents’ generation"

Source: https://www.pewresearch.org/fact-tank/2022/02/28/most-in-the-u-s-say-young-adults-today-face-more-challenges-than-their-parents-generation-in-some-key-areas/ft_22-02-25_youngadults_01/

My advice to millennials in this group is to consider starting early in investing as one of the best coping techniques for above lack of savings challenge they are having.

This might require some hard choices when it comes to discretionary splurges, such as destination bachelorette/birthdays/weddings, which seems to be extraordinarily higher for this generation than their parents. This takes a big slice away from some of mandatory savings one can start early well rounded financial well-being.

Comments

Post a Comment