How to qualify for tax free dividends and long term capital gains in taxable account

Long term capital gain and dividends is tax free for middle class household. Middle class here means households falling in lower 12% tax bracket.

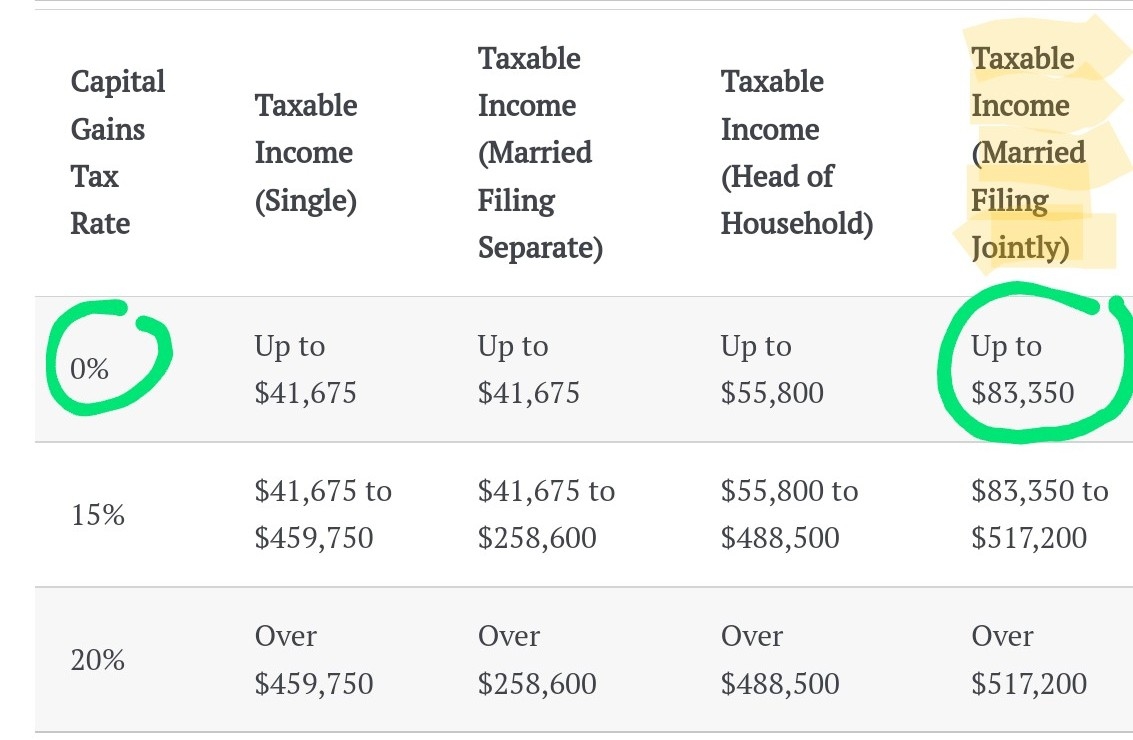

For example, joint household with up to $85,500 taxable income in 2022 fall into lower 12% tax bracket. Similarly, households with almost similar income also qualify for tax free capital gains:

Source: https://www.kiplinger.com/taxes/capital-gains-tax/603735/2022-capital-gains-tax-rate-thresholds

Note that above threshold is for taxable income. Gross income threshold is much higher after adjusting for standard deduction and other tax deferred plan contributions. See what gross income qualifies one to be in lower bracket for more detail.

Trick is to try to contribute enough in tax deferral plans such as 401(k) and traditional IRA (say, for spouse without access to 401k at work or full time mom/dad) to bring your household tax bracket to lower 12% tax bracket.

Same threshold as above $83,350 applies for tax free dividend distribution.

As such, any long term capital gain overage above this threshold is going to be taxed. So, even if we cross above threshold, we would lose tax savings only for the taxable income above this threshold. So, no need to fuss over perfect tax planning,

I found Engaging Data to be easy to use resource for one to visually see it:

For example, for tax year 2023, for joint filer with regular wages of 67500 and capital gains of 55000, this is how tax bracket looks like:

Comments

Post a Comment